Family Office

Family Offices' Tech Investment Shows Patchy Readiness – Deloitte

Family offices haven't traditionally been the fastest to embrace modern technology, but there's been a definite increase in the noise level in this area. A new report highlights how ready, or not, family offices think they are.

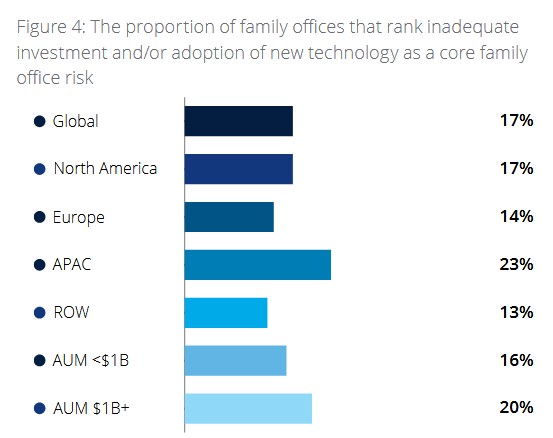

A Deloitte study of 354 family offices finds that while 43 per cent of them are developing or rolling out technology this year, one in five FOs (17 per cent) say inadequate investment in technology is a “core” risk.

Further, almost three-quarters of respondents to the survey said they are underinvested (34 per cent) or only moderately invested (38 per cent) in the operational systems needed to run a modern business.

Source: Deloitte

At a time when family offices continue to mushroom around the world – Deloitte estimates that there will be more than 10,000 of these entities by the end of the decade, up from more than 8,000 at the start of 2024.

The latest edition of Deloitte Private’s Family Office Insights Series is entitled, Digital Transformation of Family Office Operations. It provides insights into family offices’ use of operational technology across their front, middle, and back-office functions.

At a time when cybersecurity threats are a major concern, the survey found that family offices’ top focus is on using technology to support their security and risk control processes.

Some 65 per cent claim moderate/extensive technology adoption, followed by technology to support their investment operations (49 per cent), investments (47 per cent), tax and wealth planning (35 per cent), and client management activities (28 per cent).

The most common types of technology family offices use are cloud-based applications/services (which 87 per cent use), followed by virtual meetings (82 per cent), mobile communication apps (71 per cent), and identity and access management systems to safeguard one’s systems and data (61 per cent).

More than half (55 per cent) of family offices now use data analytics to a moderate or large extent in their investments, while 42 per cent do so in their operations, to identify trends/patterns and support better quality decision-making.

AI is starting to make an impact. More than one in 10 family offices (12 per cent) have begun to use AI-driven solutions to automate tasks, optimise portfolio management, enhance risk management, and more.

The families represented in the survey hold a total estimated wealth of $1.3 trillion, while the family offices have on average assets under management (AuM) of $2.0 billion and total estimated AuM of more than $700 billion.